The USDA’s National Agricultural Statistics Service last week released its forecast for acres of hops strung for harvest in the American Northwest. Lots of numbers and plenty of fun comparisons that illustrate how much has changed in five years or ten. The number of acres under wire is up, as expected, but maybe not as much as growers, literally from around the world, feared.

The USDA/NASS forecast is only for the states of Washington, Oregon, and Idaho, because until just a few years ago farmers in the rest of the country did not grow enough hops to bother tallying. That’s changed. Totaling up what’s going on elsewhere has been a challenge for Hop Growers of America, simply because there are so many small hop operations (often an acre or less, on an existing farm or literally in a large backyard). But if estimates are correct, farmers outside the Northwest will tend to about 7% of American hop acreage this year.

I’ve droned on here enough about how hard it is for the global hop market to find equilibrium. (And here and here at Beer Advocate.) Based upon inventory available after the 2016 harvest and projected beer production in 2017 it appears farmers could meet demand without planting any additional acre of hops in 2017.

So what does it mean that Northwest farmers planted about 3,300 additional acres in 2017 and growers elsewhere at least 1,000 more? That Citra will suddenly be easier to get and cheaper? Likely “no” on either count. That the next time you read a story about hop shortages inhibiting the growth of a particular brewery you should be skeptical? You bet. That there will be deals to be made for Cascade? Appears so. That farmers counting on higher prices will crash and burn? That’s the real concern. Because if they go out of business, or rip out hops to plant hazelnuts, then a few years down the road brewers will be facing a hop shortage. Yep, that whole equilibrium thing.

“You have to ask yourself, ‘Do I have the right acreage and the right varieties?'” Patrick Smith of Loftus Farms said in April at the Craft Brewers Conference. Vendors from Germany, the Czech Republic, New Zealand, Australia, England, and France all made it clear at CBC that what happens in the United States affects them as well — at home and in the states. This all provides an interesting backdrop to the upcoming International Brewers Symposium on Hop Flavor and Aroma in Beer (early registration ends tomorrow). I’ll be there in information accumulation mode and likely summarize some of what I learn in my Hop Queries newsletter (sign up at the bottom, if you haven’t already).

Meanwhile, to the numbers.

Northwest acreage grew from 50,857 to 54,135. Most of the growth is in Idaho, which boosted acreage from 5,648 to 7,169.

Top 5 varieties 2017

Cascade 7157 acres

Centennial 5534

Citra 5284

Simcoe 4498

Zeus* 3539

Same 5 varieties 2012

Cascade 3226

Centennial 1736

Citra 538

Simcoe 940

CTZ* ~5676

*Columbus, Tomahawk and Zeus are genetically identical and often sold as CTZ, but they grown under three different names. In 2017, production of Columbus and Tomahawk shrunk enough they are now simply listed with “other” (so CTZ is understated). The 2012 figure is a estimate because at the time Idaho did not publish figures for individual varieties.

Top 5 varieties 2007*

CTZ 8079

Willamette 6858

Galena 3030

Nugget 2768

Cascade 1303**

* Totals are for Washington only and Oregon because Idaho did not publish figure for individual varieties.

** Oregon did not provide a total for Cascade, which was combined with “other” and likely less than 70 acres.

Note: Washington farmers listed Centennial and Simcoe under “other” in 2007. They reported 253 acres of Centennial in 2008 and 129 of Simcoe.

Thursday was IPA Day. Friday was International Beer Day. It was also the first Friday of the month, so Session Day. You have to pick your spots and this is mine. Gail Ann Williams has told us the topic is

Thursday was IPA Day. Friday was International Beer Day. It was also the first Friday of the month, so Session Day. You have to pick your spots and this is mine. Gail Ann Williams has told us the topic is

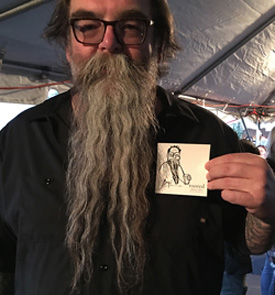

I apologize, because what follows is strictly American hop industry inside stuff. But I’ve reached the hops section of

I apologize, because what follows is strictly American hop industry inside stuff. But I’ve reached the hops section of