Administrative note: See you in May. An eclipse, the Craft Brewers Conference and the New Orleans Jazz and Heritage Festival will have us otherwise occupied this month.

There is some heavy duty science in “Predicting and improving complex beer flavor through machine learning.” You might prefer one of many summaries posted last week, such as “Scientists turn to AI to make beer taste even better,” but you’ll be missing plenty of fun details.

I remain skeptical about AI beer recipes, but the information that Kevin Verstrepen’s laboratory at the University of Leuven shares could also be put to good use by humans.

Consider this: “Both approaches identified ethyl acetate as the most predictive parameter for beer appreciation. Ethyl acetate is the most abundant ester in beer with a typical ‘fruity’, ‘solvent’ and ‘alcoholic’ flavor, but is often considered less important than other esters like isoamyl acetate. The second most important parameter identified by SHAP is ethanol, the most abundant beer compound after water.”

Ah, yes. alcohol.

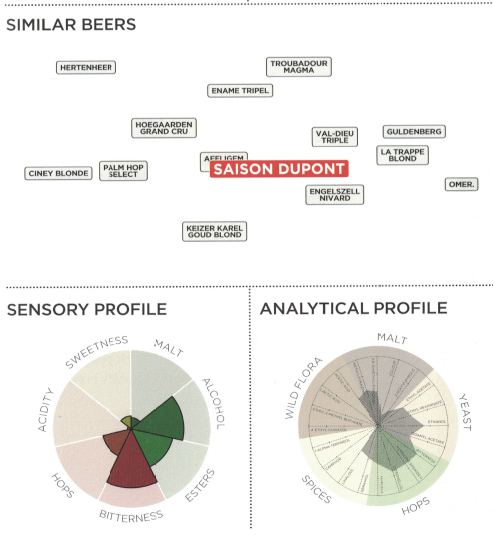

So plenty to read in the Nature Communications article, and a lot of sexy charts. Even more in the lab’s book, “Belgian Beer: Tasted and Tested” (Image below is from the book.) However, because it appears to me the database is drawn from that book, it seems that needs to be a lot bigger.

QUOTE OF THE WEEK

“Beer at its best is a reflection of a golden field of barley, a reminder of the rich aroma of a hop garden. Scientists can argue endlessly about the merits of the man-made concoctions which go into much of today’s beer but the proof of the pint is in the drinking. . . . the best of British beer is produced from the gifts that nature gave us and by methods which have been proudly handed down over the centuries. The story of beer is a story of nature and of craftsmanship; a story of farmers and brewers who join forces to create beer naturally.”

— The quote, and the photo above, come from “Beer naturally,” called out in Real Ale as Folk Horror. I love the photos in that book so much I had forgotten there are also words.

LEDE OF THE WEEK

In 1873, the manager of an ironworks in Söderfors, Sweden, was about to retire. When handing his responsibilities over to the next manager, he worried about one issue in particular: the future of a beer barrel.

This was not just any barrel, he explained in the letter to his successor. This was a barrel he had been given by the previous manager when he himself took over the ironworks half a century before, in 1820. In fact, he wrote, the barrel still contained beer from when it was first filled—in 1794.

What the retiring manager wanted was for his successor to continue taking care of this barrel. To do so, every other year, he needed to pull off half the barrel’s contents for drinking, then brew new beer to refill the barrel, and “well maintain it.”

Those three words were underlined in the letter, just to make it clear how strongly he felt about it. His desire was for this 79-year-old barrel to be passed on to coming managers of the ironworks “from each to each, into the remotest future.”

How far the manager got his wish is not known, but in 1952 the barrel—by then more than 150 years old—was still being maintained in Söderfors.

— From Hundraårig Öl: A Hundred Years (or More) in the Making.

WHEN X AND THE BLOGOSPHERE MEET

– Cask Ale in the North, South, and Very Far West

Seen today in Preston. I think we can all agree with this. pic.twitter.com/7sanp2z5l4

— John Clarke (@Beer4John) March 30, 2024

YOU MIGHT ALSO ENJOY

– Look out for those sneaky strong German beers. Strong in this case may mean 5.2% ABV beers. Wait until 2026, when the United States hosts the World Cup and those British drinkers encounter Double IPAs and pastry stouts.

– After 15 Years Upright Brewing still grooving and improvising to their own tempo. Upright Brewing founder Alex Ganum is a treat. And this true story about how he found the space for his brewery in Portland, Oregon, still seems hard to believe. “I was at Amnesia Brewing on Mississippi having a beer with a buddy and he said, ‘have you found a space for the brewery yet?’ I said no, and a woman was sitting at the table next to us who worked with the owner of the [Leftbank Building]. She overheard us and said, ‘oh you’re looking for a spot for the brewery? I work with this guy who is renovating this building,’”

– Pizzeria Paradiso Reconsidered. An OG.

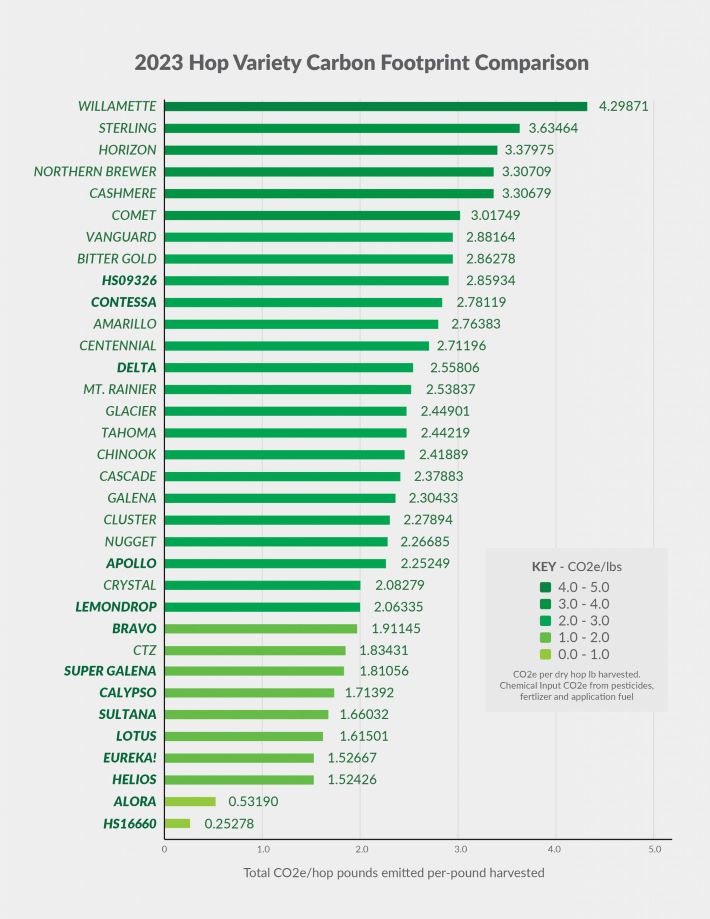

From Hopsteiner

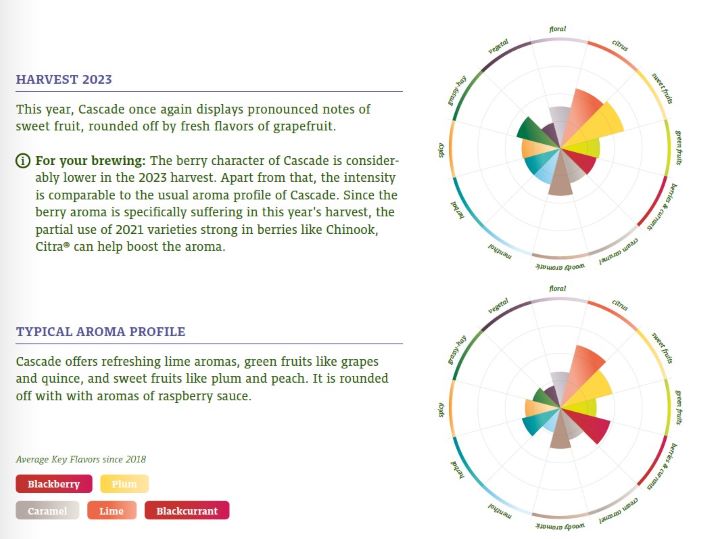

From Hopsteiner From BarthHaas

From BarthHaas